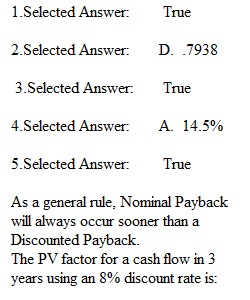

Q • Question 1 0.4 out of 0.4 points The time value of money theory consists in four beliefs: (1) Investment risk is important; (2) money today is worth more than money tomorrow; (3) inflation must be considered when making investment decisions; and (4) investment opportunity costs must be considered. • Question 2 0.4 out of 0.4 points The PV factor for a cash flow in 3 years using an 8% discount rate is: • Question 3 0.4 out of 0.4 points As a general rule, Nominal Payback will always occur sooner than a Discounted Payback. • Question 4 0.4 out of 0.4 points Hamilton Corporation has decided to seek outside financing. The CFO is attempting to compute Hamilton's weighted average cost of capital. You have been provided the following information. Capital Structure Weight Cost Debt 30.00% 11.60% Preferred 15.00% 12.10% Common Equity 55.00% 16.70% The weighted average cost of capital for Hamilton is: • Question 5 0.4 out of 0.4 points The capital budgeting process requires four steps to complete: (1) Finding new investment opportunities; (2) Collecting the relevant data; (3) Evaluation and decision making; and (4) Reevaluation and adjustment to plans as necessary.

View Related Questions